Undetected roof leaks can lead to significant damage over time. Even a small crack or hole can cause damp to build over time.

As our policies do not cover "maintenance or damage as a result of wear and tear," it's crucial to promptly address any roof leaks. Neglecting proper care can result in expensive repairs and impact your insurance coverage.

Our comprehensive guide on roof maintenance, leak prevention, and handling leaks can help you manage your roof throughout the year.

1. Locate the leak

Not all leaks are obvious. Damp may not always show directly below the root cause due to the pitch of the roof, so investigate carefully.

If water is pouring in, get a bucket to catch the water straight away, then start to trace it back to its source. You may need to access the roof space if it is safe to do so.

How to find roof leaks

You’ll be able to look for exterior damage from outside your home and, if you spot something, you can decide whether you can fix it yourself or need a professional.

If you need help finding a leak, try the following:

- On a rainy day – Shine a torch onto the inside of your loft roof, any water coming in should shine under the torchlight

- On a dry day – Spray a hose onto the suspected leak area from the outside. Have someone inside to spot the leak, and make sure you protect your belongings from water damage

If you locate the leak and want to fix it yourself, make sure you have the right tools. Use ladders or scaffolding where necessary, take your time and consider the weather.

2. Patching the roof leak

If the leak needs extensive repairs, you can patch it to prevent further damage whilst you wait for a professional. A patch should only be done as a short-term measure if it is safe to do so. Home emergency cover could help with urgent repairs like this.

3. Call a professional

To make sure your roof is fixed and the leak won’t reopen, you need to call a professional. They will be able to check for any issues and weaknesses around the leak site and ensure it is secure.

4. Preventing future leaks

It’s important to get to know your roof’s strengths and weaknesses so you can spot any issues before they become serious:

- Regularly inspect your roof and particularly after bad weather

- Be diligent about clearing debris from gutters as this can quickly lead to more serious problems

- Where possible, cut back trees from getting too close to your property. Falling debris, like leaves and algae, can cause decay which can result in leaks

- Maintain chimneys and ventilation ducts. Poor ventilation can cause any wooden structures in your roof to rot, which may not be visible externally

- Be extra diligent as you prepare for winter. Weaknesses in your roof can escalate into major problems due to heavy rain and storms in winter season

Causes of roof leaks

Knowing the signs of a leak can help with those spot checks for general roof maintenance before a problem gets more serious. Here are some of the common causes to look out for:

Missing or cracked tiles or roof slates

Missing tiles or cracked roof slates can be easy to spot upon inspection. You can expect to pay around £200 for a relatively simple replacement of several roof tiles. This is a rough estimate. Your cost will vary depending on your house and circumstances.

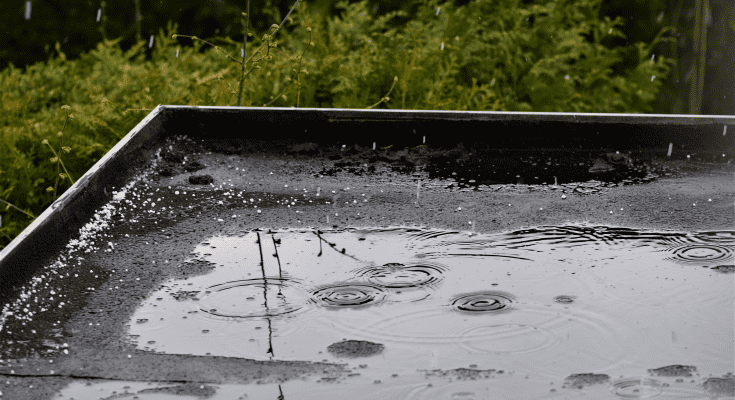

Flat roofs and valleys

Improperly laid flat roofs or blocked valley gutters can cause water to pool, leading to leaks directly underneath. Contact an expert for repairs; consider reaching out to the National Federation of Roofing Contractors Limited (NFRC) for local repair services.

Flashings and joints

Flashing around roof joints, skylights and chimney stacks can often be a culprit of damp. Over time the metal and sealant corrode and need re-sealing or replacing. Mortar joints in the brickwork of chimney stacks, and the mortar beds of chimney pots, can also be damaged by frost.

Ensure any obvious gaps are sealed and old flashing replaced at the first sign of a leak. If you’re in an older property, consider asking a local contractor to carry out a roof inspection every few years. The cost of repairing flashing can be between £100 and £250 per metre. This is a rough estimate. Your cost will vary depending on your house and circumstances.

Failure of underlay

Holes in felt underlay can help contribute to a loss of tiles or slates in adverse weather or be the source of a leak itself. If you have access to your loft, you’ll be able to see the underlay. Tears can be repaired quite easily, but if rot's causing the damage, the underlay will probably need replacing.

The cost of replacing underlay will be factored into the overall price of repairing the damaged area, as it's a job that will include removal of tiles and other tasks.

Blocked guttering

You can usually spot a blocked guttering problem by water gushing down from the area of the blockage when it rains. Clean out your gutters regularly, particularly during winter when leaves and moss can accumulate. If you’re not comfortable attempting this, then a reasonable price for this type of work would be in the region of £4 per metering of guttering. This is a rough estimate. Your cost will vary depending on your house and circumstances.

Soffit and fascia damage

Soffit and fascia keep your guttering in place, underpinning and encasing the area under roof beams. They also help keep water away from the wooden framework under the roof.

You should ensure that soffits and fascias are regularly repainted to protect against rot. You could also consider replacing timber with lower-maintenance PVC boards.

Brick chimneys

Repairing brick chimneys is not usually an easy job. They can be difficult to get to and take a battering from the elements. Often what looks like an 'easy fix' will turn out to be an extensive task.

Mortar joints in the brickwork of chimney stacks and the mortar beds of chimney pots can be damaged by frost. Plus, chimneys come in various shapes and sizes and the complexity of the task will involve navigating around these carefully.

Skylights

Skylights made of acrylic or polycarbonate are a popular and cost-saving addition, flooding attic spaces with welcome sunlight. On the rare occasion they do go wrong it’s important to know what your options are. Here are some common issues that skylights suffer from:

- Daylight glare and UV damage – this can be caused by the skylight coming in direct contact with the sun’s rays

- Rainwater and snow contact can cause damage over time

- Heat can escape through a window just as easily as it can be transmitted through it. Pay attention to skylight placement during installation

- Ice dams can form during colder months allowing water to pool and seep into the house through seals and flashings

- Bathrooms are not ideal places to have skylights due to the constant levels of warm moisture. Use ventilation fans to extract the air outside

Typically, a residential skylight will sit on a raised curb surrounded by tiles while metal flashing will keep it watertight. Replacing a small Velux skylight may cost about £550.

How much does a roof repair cost?

Roofers charge based on the complexity of the task, not time. Even a simple tile replacement may have added complications, such as the need to erect scaffolding for access. They also consider the number of stories a home has, with bungalow roofs being easier to access than multi-story townhouses. Roofs with different levels, skylights, dormer windows or chimneys can also make the job more complex.

Always use a trusted roofer and don’t assume it’s an easy task. Home insurance may be able to help towards the cost of fixing your roof if there is storm damage.

Does home insurance cover roof leaks?

Make sure you understand exactly what your buildings and contents insurance will cover you for in the event of damage to your roof.

Like most insurers, we won’t cover damage that occurs over time as a result of normal use or ageing, such as damp. However, if your roof is damaged during a storm it could be covered. Your insurance may have emergency assistance that provides cover for an emergency repair to your roof.

Protect your home with insurance

Regular roof checks and ongoing maintenance are an important part of property ownership. Spotting issues early can help avoid costly repairs and prevent further, more severe damage later down the line.

Although home insurance won’t cover damage from 'wear and tear' it could give you financial support to fix your roof if it’s damaged by something out of your control. Also, with our Home emergency cover, you get access to legal and emergency repairs advice, 24 hours a day.